AI based Omni Channel BOT Platform for Digital Lending

Your Trusted Partner for automating your customer journey.

ProcMATE for Digital Lending provides banks and financial institutions with a BPA toolset that can be used to model and automate the Digital Lending process with a view of optimizing costs and improving efficiencies.

This BOT automates business processes and use the underlying machine learning layer to continuously monitor the transactions which helps customer by providing real time eligibility of loans and credit approvals. A customer can be engaged using Social, digital & enterprise applications.

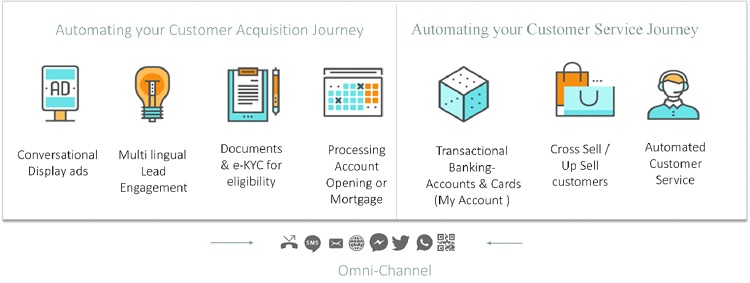

Omni-Channel, Multi Lingual Conversational engine to automate Customer Acquisition & Customer service.

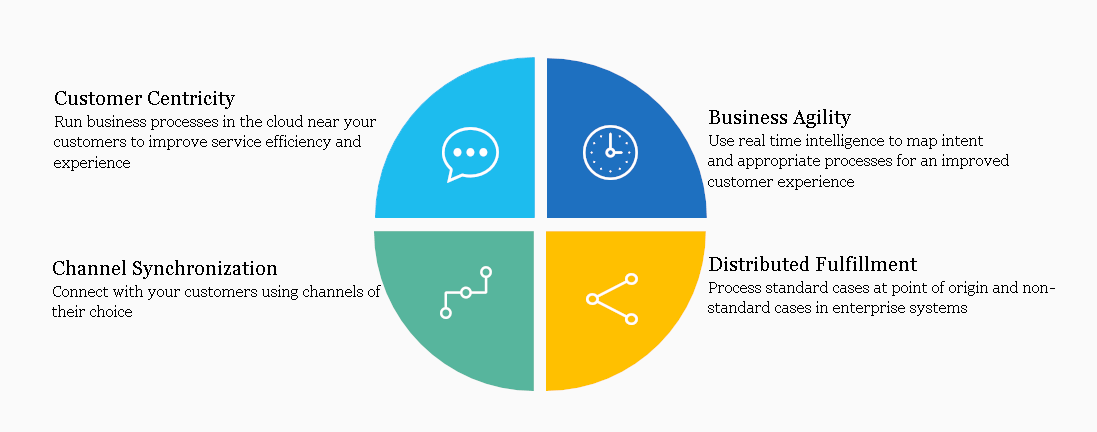

This Omni Channel BOT Platform bring Banks Closer to Customers by automating customer centric business processes in a channel where customers are present.

How Does ProcMATE – A BOT for Digital Lending Creates a Difference

Conversations are driving the next wave of digital growth. ProcMATE – Omni Channel BOT for Digital Lending is all set to impact the banking industry in a big way.

Industry Use Cases

Customer Eligibility

Machine learning continuously monitor transactions which helps customer by providing real time eligibility of loans and credit approvals.

Customer E-KYC

In built decision making system that can be configured with parameters based on organizational process for KYC.

Document Verification & Reconciliation

In-built intelligence to verify the documents automatically.

Unstructured Data Processing through OCR Technology

AI based OCR (Optical Character Recognition) technology present in ProcMATE, quickly and accurately converts unstructured data from documents into structured data which can be then further stored and processed as per business requirement.

Predictive Analytics

Evaluate customer credit risk using application and other relevant data for less biased real time underwriting decisions.

Predict risk of loan delinquency and recommend proactive maintenance strategies.

Route call-center cases based on multi-model data (e.g. customer preferences, audio data) to increase customer satisfaction and reduce handling costs.

Discover New Trends /Anomalies

Identify fraudulent activity using customer transaction and other relevant data.

Discover news complex interactions in the financial system to support better risk modeling and stress testing.

Resource Allocation

Optimize labor staffing and distribution to reduce operational costs in front and back office.

Customer Behavior Insights

Predict risk of churn for individual customers/clients and recommend renegotiation strategy.

Forecasting & Risk Analysis

Predict risk of loan delinquency and recommend proactive maintenance strategies.

Offerings based on Customer Behavior

Personalize product offerings to target individual consumers based on multi-model data (mobile, social media, location, etc.)